Second Home - a wise Investment

“Managing real estate has become much more of a common component of someone's longer-term retirement plan”

If you’re not going to put money in real estate, where else?

Real estate has always been a worthier and fruitful investment avenue, less volatile to market conditions. Historic measures like reduction in stamp duty, premiums for real estate, and reducing home loan rates have encouraged these new-age home buyers to invest in residential space.

Don’t wait to buy real estate. Buy real estate and wait!

Buying a second home in the city or suburban areas is a good investment idea considering it can help generate a decent rental income. Keeping in mind the current scenario, the key source of income is being affected due to the pandemic for many. Real estate offers the prospect of earning a second income.

With some companies continuing to allow working from home, you may be envisioning yourself tapping away at your laptop from a second home. If so, you're not alone. In fact, according to a few real estate reports, the second home market experienced 128 percent year-over-year growth between March 2020 and March 2021.

Almost 80% of potential second home buyers intend to hold the properties for more than five years. As the ticket size of the property increases, so does the intended investment period, reflecting the intent to attain capital appreciation and rental return before eventual exit from the property.

Second home buyers/investors should always keep a few things in mind before they start their passive income journey

Establish and determine your reasons to invest in a second home

The touchstone for analysing the need for a home highly depends on whether you plan to use it as an investment or for self-occupation. One should have clarity for what way this investment will fit into their overall portfolio. Basic due diligence is a must before investing money in a second home.

Evaluate your Budget

To ensure that the second home doesn’t hamper the financial aspect of any home-buyer, one should analyse the overall capital value at hand and a pre-defined, well-calculated budget for the second home.

The Return on Investment

While purchasing a second house, one of the major factors you need to keep in mind is the potential return on investment (ROI) from the property. Usually, homes around commercial areas provide a higher ROI than homes in secluded areas. Keeping this in mind, it is a good idea to invest in fast-appreciating localities where the investment is not as high as the well-established neighbourhoods.

Example

Jai is residing in Bangalore. He recently got promoted at his job from an Associate to Vice President in his department. He was studying and going through a few wealth reports on what might be a good investment option at this point in time, post the pandemic. Jai is thinking of investing some funds into the real estate market.

Why the Lure of Buying a Second Home?

Jai is not basing his decision on the emotional argument about how having multiple real-estate properties is a boon for his next generations. His logic is based on numbers.

Building an Asset Without Paying Too Much Money

Who minds the passive income, especially if it helps you pay your EMIs and build an asset for yourself, right? That’s what Jai also thinks. Buying the second house and letting it out is a common practice.

Jai lives in South Bangalore, and the house he is eyeing will cost him Rs 80 Lakh. Now, the price-to-rent ratio is which is the percentage of the property’s price you can get as rent in South Bangalore is around 23 annually. Hence on the property of Rs 80 lakh, Jai calculated he will get Rs. 29,000 approx. as monthly rent.

Now, Jai will take a loan of Rs 50 lakh to fund this house purchase. Considering he applies for a home loan of Rs 50 Lakh and an assumed fixed loan interest of 6.75%, his monthly EMI comes to around Rs. 38,000

With the rent of Rs 29,000 coming as rent, Jai calculated he will need to pay just Rs. 9000 extra every month and he will build a property. With him having a stable job, that amount is manageable for him.

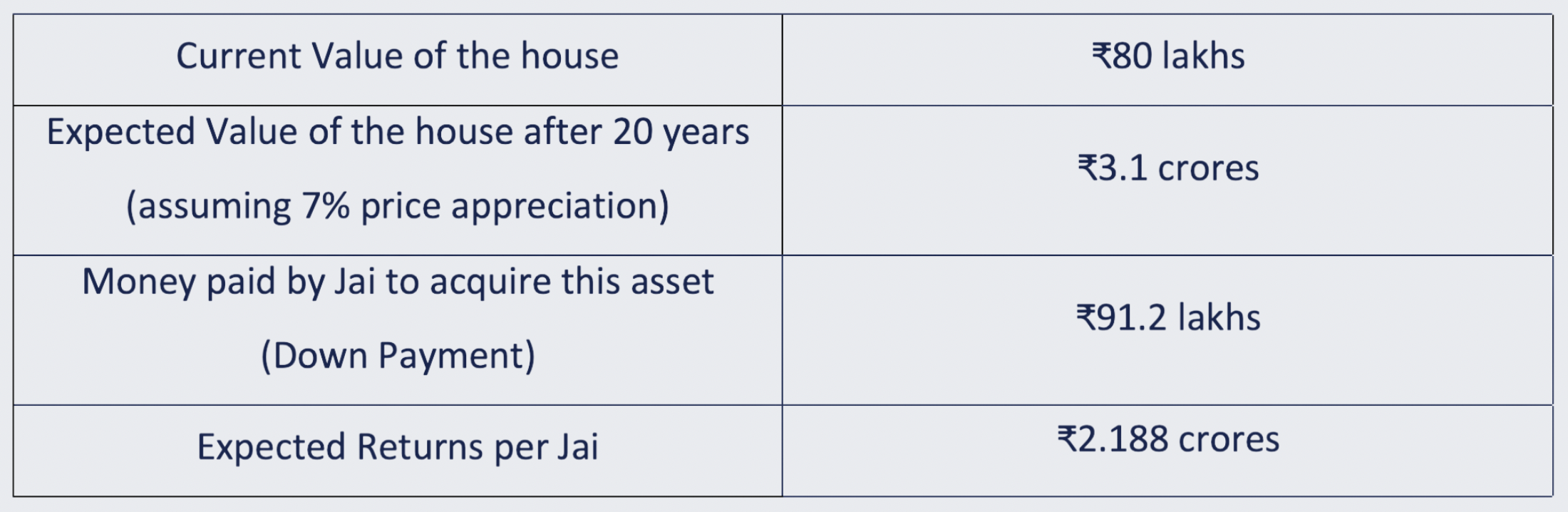

The average return that a real estate investor got from his investment in the area where Jai is looking to invest in, in the past few years is 7-8%. Jai is assuming that the same increment in the property value will continue for the coming years as well. Based on this assumption, here is what Jai figured will be his overall return:

A neat Rs 2.2 crore approx. from an investment looked pretty good to Jai. What further convinced him was all the tax benefits he could avail of when he took a home loan.

“Buying real estate is not only the best way, the safest way, but the only way to become wealthy”

Advantages Of Owning a Second Home

Whether you're buying your second home as a vacation home, rental property, or secondary residence, owning a second home can come with financial benefits as well as the advantage of a more flexible lifestyle.

Potential rental income

If you're looking for some additional income, one of the benefits of owning a second home is that you can potentially rent it out and make enough money to cover the house's mortgages and expenses as well as have some profit left over for daily living costs. You could also take advantage of short-term rental services like Airbnb to rent to vacationers and business travellers on a more flexible daily, weekly or monthly basis.

Potential property appreciation:

A second home can also be a good investment if you buy a property in a neighbourhood with rising home values.

Tax benefits

There are guaranteed tax benefits on availing of a home loan in India to buy a second home. You get tax savings on the principal amount under Section 80C and tax deductions on the home loan interest rates paid to service the loan under Section 24B.

Disadvantages Of Owning a Second Home

While owning a second home can be a good investment opportunity and possibly improve your quality of life, there are several costs and risks to consider when making your decision.

Ownership costs

One of the main disadvantages of owning a second home is that you have to pay for all the ownership costs just like you do for your primary home. Unless you pay for the property in cash, you can expect a monthly mortgage payment along with property taxes, homeowners' insurance, regular maintenance costs, etc.

Ongoing maintenance work

Maintaining a single home takes a lot of work, so adding a second property will double that for you. This can mean spending your days off work traveling to the second home to clean it, do basic repairs and maintain the lawn. Of course, you have the option of hiring others to take care of the home, but keep these added costs and hassles in mind when making your purchase decision.

Work and risks managing rentals

Along with the potential rental income comes the work required to manage the property and deal with tenants' requests. You could hire someone else as a property manager if needed, but this cuts into the money you'll make from the rental. Also, you have to deal with the risk that the tenants may not treat the property well and could cause damage that will cost you a substantial amount to repair; purchasing landlord insurance can help remediate this risk.

Potential depreciation

Although your second home may grow in value, there is no guarantee this will happen.